Published on Tuesday, December 9, 2025

Access our latest property investment summary by completing the form below.

Still, this may only be short-lived as the long-term forecast remains strong.

The commercial real estate industry is poised to benefit from strong long-term tailwinds that should help it navigate ongoing economic uncertainty. In the near term, however, a series of crosscurrents is expected to influence property performance, according to a new forecast from Marcus & Millichap.

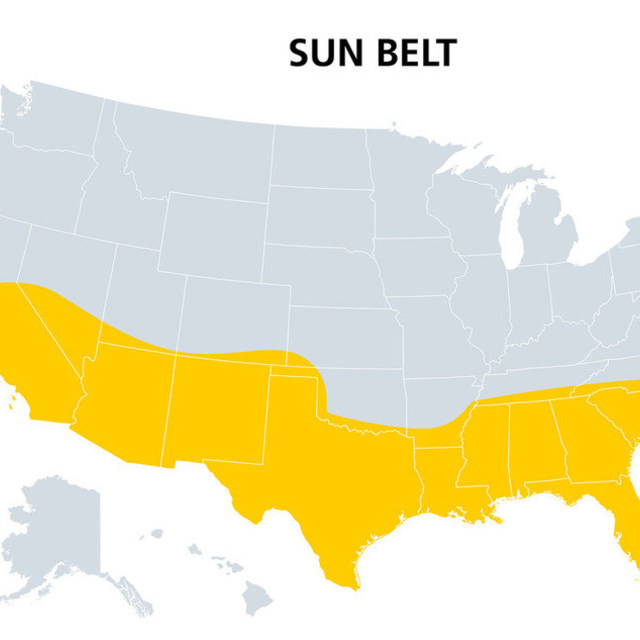

The most immediate pressures are likely to affect high-development Sun Belt metros, while markets with limited construction pipelines are expected to maintain their momentum, the report said.

The U.S. has just emerged from a historic wave of apartment construction, with 1.4 million units delivered over the past three years. Strong demand for rental housing has kept vacancy rates in check. Today, national vacancy stands at 4.6%, down 130 basis points from the early-2024 cycle peak.

Still, the rapid pace of net absorption is beginning to moderate, driven in part by economic uncertainty tied to recent tariff policy changes that have weighed on hiring. Between May and September, only 193,000 net jobs were added, compared with half a million in the first four months of the year. The impact has been especially pronounced for Gen Z, with unemployment among the 20- to 28-year-old renter cohort rising to 7.4% in September, compared with the overall U.S. rate of 4.4%.

Migration to Southern metros has tapered from pandemic-era highs, contributing to higher vacancy rates, particularly in the Sun Belt — the region that experienced the highest level of development. Vacancy in these markets now runs roughly 200 basis points above the national average outside the region. Meanwhile, average effective rents in heavily developed markets have trended downward over the past three years.

Despite these near-term challenges, multifamily performance is expected to improve over the longer term. Marcus & Millichap noted that construction is likely to remain subdued, as elevated material and labor costs continue to discourage new development.

High homeownership costs are also supporting rental demand. The monthly payment on a median-priced home is nearly $1,200 higher than the average apartment rent, according to the report. Lease-renewal rates remain above the long-term average at 55%.

“The headwinds slowing household formation are likely temporary, as some demand is being deferred until economic uncertainty eases or job security improves,” Marcus & Millichap said.

“If job creation and consumer sentiment rebound, high home prices coupled with limited rental construction could drive a relatively quick improvement in multifamily performance.”